Private equity-backed dental service organizations dominated healthcare acquisitions in 2024 with 242 dental M&A deals—more than any other medical specialty¹. As DSOs receive fresh capital and intensify acquisition activity, independent dentists face mounting pressure to consider corporate buyouts.

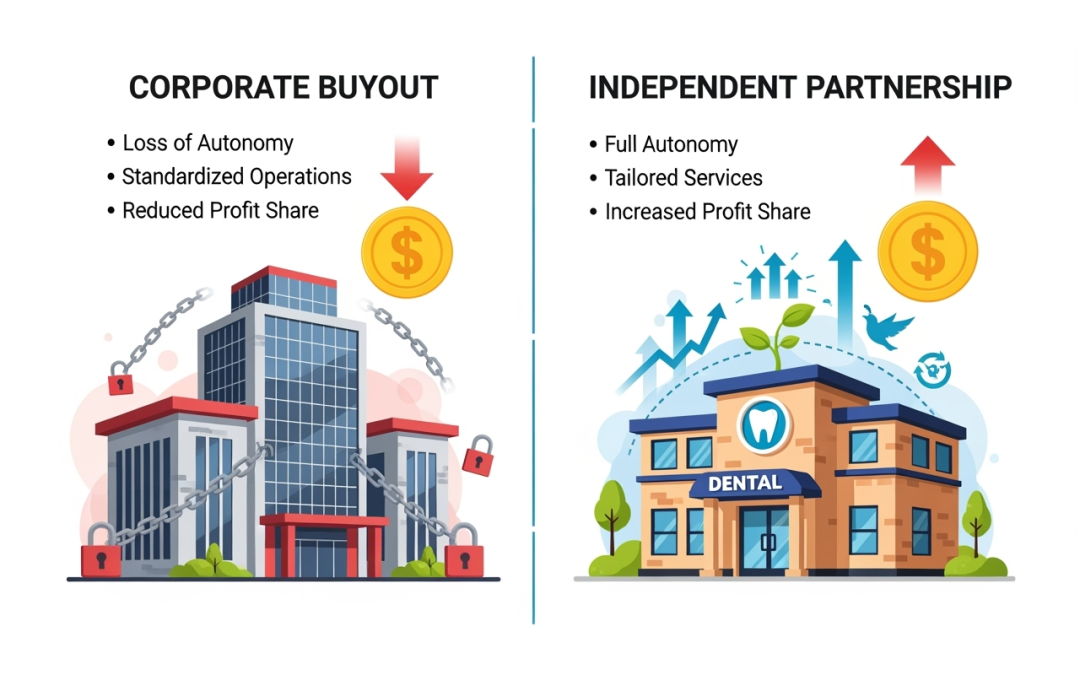

Yet beneath attractive upfront offers lies a fundamental question: Is sacrificing professional autonomy worth immediate financial gain? The answer depends on understanding both the true cost of corporate ownership and emerging alternatives that preserve independence while maximizing long-term value.

The DSO Expansion Reality

Private equity-backed DSOs actively seek acquisitions, viewing dental practices as stable, long-term investments². The typical acquisition model involves purchasing practices through “earn-out” agreements, where sellers receive initial payments followed by performance-based compensation over several years.

According to industry analysis, DSOs usually purchase practices and take over ownership through arrangements that fundamentally alter operational control. While initial offers may appear generous, the long-term implications often become apparent only after transition completion.

The Hidden Costs of Corporate Buyouts

Loss of Clinical Decision-Making Authority Corporate ownership gradually erodes clinical autonomy through:

- Standardized treatment protocols that may conflict with individual patient needs

- Pressure to utilize specific vendors and technologies

- Production quotas prioritizing volume over patient care

- Limited flexibility in treatment planning and innovation

- Reduced ability to implement personalized patient solutions

Cultural Transformation Impact Corporate ownership brings systematic changes:

- Implementation of standardized corporate policies

- Reduced staff autonomy and decision-making authority

- Potential turnover as existing staff adapt to corporate culture

- Loss of personal relationships defining independent practice

Financial Structure Limitations While offering immediate liquidity, long-term financial implications include:

- Earn-out provisions tied to corporate performance metrics

- Limited ability to benefit from practice value appreciation

- Reduced control over operational investments

- Standardized fee structures not reflecting local markets

Market Data: The True Cost of Corporate Control

Recent industry analysis reveals concerning trends:

Valuation Impact: Independent practices undergoing strategic preparation often achieve comparable or superior valuations while maintaining control.

Long-term Value: Corporate structures typically limit sellers’ participation in future value appreciation, potentially costing hundreds of thousands in wealth building.

Professional Satisfaction: Industry surveys consistently show lower satisfaction among dentists in corporate-owned practices compared to independent practitioners³.

The Independent Alternative: Strategic Partnership Models

Minority Equity Partnerships Unlike full corporate buyouts, minority equity partnerships allow dentists to:

- Retain majority ownership and operational control

- Maintain complete clinical decision-making authority

- Preserve existing practice culture and relationships

- Access strategic resources without mandatory utilization

- Participate in ongoing practice value appreciation

These partnerships typically involve selling 20-40% equity while retaining majority control and management authority.

Strategic Support Without Mandates Quality partnerships provide comprehensive support without corporate restrictions:

- Operational excellence systems implemented on your timeline

- Technology resources with implementation flexibility

- Financial management tools while maintaining decision control

- Business development guidance without mandatory requirements

Financial Comparison: Corporate vs. Independent Outcomes

Long-term Wealth Building Example (Practice valued at $2 million):

Corporate Buyout Scenario:

- Immediate payment: $1.2-1.6 million

- Earn-out potential: $400,000-800,000 over 3-5 years

- Future value participation: None

- Total potential: $1.6-2.4 million

Independent Partnership Scenario:

- Immediate equity sale (30%): $600,000

- Retained ownership: 70% ($1.4 million current value)

- Value appreciation (10% annually): Compounding on retained equity

- Five-year total value: $2.85+ million

Operational Cash Flow Benefits Strategic partnerships improve cash flow through:

- Reduced supply and operational costs (5-15% of revenue)

- New revenue stream implementation ($100,000-300,000+ annually)

- Enhanced efficiency and productivity

- Improved insurance reimbursement rates

The Independence Preservation Factor

Strategic preparation allows dentists to:

- Choose transition timing based on personal goals

- Maintain clinical autonomy throughout the process

- Preserve practice culture and values

- Access strategic resources without surrendering control

- Optimize financial outcomes while protecting professional legacy

Making the Right Choice

The decision between corporate and independent sale isn’t just financial—it’s about preserving the values and relationships that define your practice. Strategic partnerships prove that preserving autonomy and maximizing value aren’t mutually exclusive when structured correctly.

HPA’s MVP Program: The Independent Alternative That Protects Your Legacy

At Health Professionals Alliance, we believe only doctors should control dentistry. Our MVP Program offers everything corporate buyers promise—strategic support, operational efficiency, and financial growth—without surrendering autonomy.

What makes our MVP Program different:

- Complete clinical autonomy—your treatment decisions remain entirely yours

- Strategic support without mandates—access to 80+ partners without forced utilization

- Proven results—practices typically see 10% year-over-year valuation increases

- Your timeline, your terms—transition when ready, not when shareholders demand

- Phase 2 option: Sell up to 40% equity while maintaining majority control (Years 1-3)

- Phase 3 option: Complete transition on your schedule (Years 3-5+)

Our MVP members maintain practice culture, staff relationships, and patient connections while accessing DSO-level resources. You get strategic partnership benefits without sacrificing what makes your practice uniquely yours.

Don’t let corporate buyers capture your practice’s upside value. Visit www.hpamembers.com or schedule a consultation directly with Aaron at https://calendly.com/aaron-hpa to discover how our MVP Program can maximize your practice’s worth while preserving independence.

Sources:

- Florida Healthcare Law Firm – Dental Practice Mergers: Guide to Growth & Success (2024)

- Professional Transition Strategies – How to Sell Your Dental Practice in 2025 (March 2025)

- White Coat Investor – The DSO Down-Low: How Private Equity Has Infiltrated Dentistry (May 2024)

Disclaimer: This article was written with the assistance of artificial intelligence to help provide comprehensive information and industry insights.